Tax Flexibility

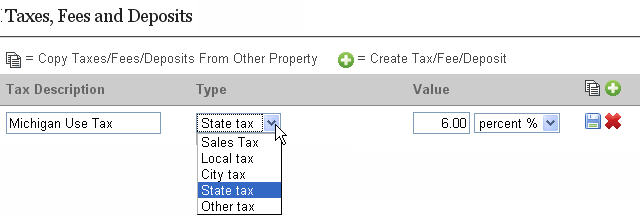

InnFirst.com allows property owners / managers to setup all types of taxes and local surcharges. Federal, state, local and city taxes are all supported. Per day flat taxes are also supported. So it doesn't matter if the tax is a percentage of the total reservation or a flat amount per day per property or room, the InnFirst.com system supports it all.

Tax Exemptions

Some services may not require taxing in your area, those can be set up to be tax exempt. Additionally, there are non-profit groups and schools that have special tax exemption numbers that do not require the property owner to collect tax, InnFirst.com has enough flexbility that those reservations can be edited, the tax exemption number of the guest logged and the reservation made tax exempt.

Read more

Read more